Local BE Requirement in Thailand: Entry Barrier or Advantage?

- Admin 1

- Sep 17, 2025

- 3 min read

Updated: Nov 24, 2025

Unlike many ASEAN countries that accept bioequivalence (BE) data from Europe or other SRA-accredited centres, Thailand requires most oral solid dose (OSD) generics to undergo BE studies conducted locally — regardless of whether the product is manufactured domestically or imported.

On paper, this is not a discriminatory rule: Thai companies face the same obligation. In practice, however, it acts as a strategic market filter. The associated costs, timelines, and procedural hurdles naturally tilt the field toward companies with resources, experience, and strong local networks. The result? Fewer players, slower commoditization, and more durable margins for those who move decisively.

Why Thailand Demands Local BE

Officially, the policy is rooted in patient safety and public confidence. With hospital tenders dominating the market and widespread generic substitution, regulators want robust evidence that products perform identically to their references under Thai conditions.

Local BE provides that assurance — through Thai ethics committees, Thai volunteer populations, and in-country analytical oversight. But there’s an economic dimension too:

Builds the domestic BE industry and supports local CROs.

Slows competition, limiting “me-too” saturation.

Protects rational pricing, allowing first movers a window before the inevitable price collapse in open-entry markets.

Who Must Conduct BE — and Who’s Exempt

The rule applies primarily to oral solid dosage forms: tablets, capsules, and similar products. It does not apply to injectables, ophthalmics, topicals, or inhalers — these can rely on bibliographic or CMC documentation, as in Europe.

Exceptions exist for:

Urgent public-health drugs (Category 1).

Oncology or life-threatening disease products.

Products where BE cannot be technically performed in Thailand.

A biowaiver may be granted for BCS Class I or III immediate-release drugs, provided the formulation matches the reference in excipients and dissolution profile. In practice, Thai FDA grants such waivers sparingly. Class II/IV molecules, narrow-therapeutic-index (NTI), high-variability (HVD), and modified-release formulations almost always require full BE.

Even if identical strength and form already exist on the market, a new MA application must typically undergo local BE again — unless it clearly qualifies for a biowaiver. This makes Thailand one of the strictest regulators in ASEAN on the “local-BE-only” policy.

ASEAN Recognition: Cautious Integration

Under Article 6 of the ASEAN BE Mutual Recognition Arrangement (MRA), member states must consider BE studies conducted by accredited ASEAN-listed BE centres.Thailand signed the agreement but has adopted a conservative implementation. While ASEAN data may be reviewed, the final decision remains national — and in practice, Thai hospitals often require specifications explicitly stating “BE with Thai volunteers.”

Thus, even where ASEAN data exist, Thai BE remains the safer and faster route to acceptance.

Market Impact: Time as the Real Currency

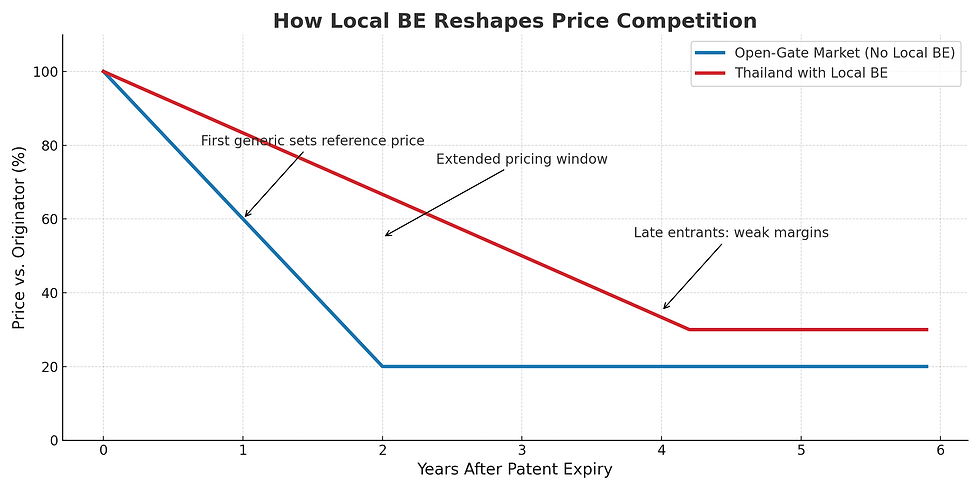

Open-entry markets accepting foreign BE data see multiple entrants arrive simultaneously, collapsing prices quickly. Thailand is different:

First generics gain a premium window to anchor hospital tenders.

Early followers (second to fourth entrants) can still enjoy attractive returns.

Late entrants face commodity pricing and weak margins.

In other words: BE doesn’t just cost money — it buys time. The companies that act early monetize that time; those who hesitate lose it.

Costs and Timelines

Executives must price BE into their investment calculus. Typical costs:

Biowaiver (BCS I/III): €20,000–€40,000

Standard BE (single-dose, fasting): €60,000–€120,000

Complex BE (fed/fasting, MR/NTI/HVD): €150,000–€250,000+

Duration: 9–15 months, dependent on CRO capacity and design study.

These figures are intimidating — but they also act as a natural moat. Many competitors simply never cross it. Thai BE can begin once the final formulation and batches are ready. Waiting for CPP issuance is not necessary. BE doesn’t just cost money — it buys time. Companies that invest early convert that time into market share; those that hesitate arrive to a commoditized battlefield.

Who Wins? Who Pays?

Local manufacturers: Better positioned with CRO familiarity and networks, but still carry the capital burden.

SMEs from abroad: Those who invest gain slower price erosion and margins; those who hesitate arrive to a commoditized market.

Multinationals: They can afford it — and it keeps smaller players out.

Distributors: Often expect co-funding of BE depending on overall business case. The structure of these deals (milestone-based vs open-ended) determines whether foreign firms retain profitability.

Thailand is not a market for opportunistic launches. It rewards deliberate, well-structured investment cases:

Rank molecules by value after BE costs.

Treat biowaivers as accelerators, not anchors.

Negotiate partner agreements with BE cost-sharing tied to outcomes.

Move early: the first 3-5 entrants win market share, the rest compete for crumbs.

MedExport Asia’s Role

At MedExport Asia, we help companies validate portfolios and quantify what Thailand’s BE requirement truly means for market entry. By aligning strategy, partner expectations, and cost-sharing mechanisms upfront, we ensure that BE becomes not a burden but a lever. For the right products, the barrier is precisely what creates the reward—because every other foreign company faces it too.

Sources; TFDA, ASEAN Guideline on BE, ICH M9, WHO TRS, ClinRegs Thailand, Chulalongkorn PK Center, Mahidol IBS, Chiang Mai University BE Unit, ProductLife Group (ACTD/CTD ASEAN), Thai CRO tariff data (2023–2025).

By MedExport Asia Co,.Ltd.

Comments